本文的作者是纽约大学金融系教授Aswath Damodaran,号称“华尔街太傅”,目前在NYU的商学院教授估值课程,是华尔街最热门的教授之一,为华尔街培训了大量的精英。本文作者主要讨论了从财务比率看全球股票定价。

When looking at how stocks are priced and especially when comparing pricing across stocks, we almost invariably look at pricing multiples (PE, EV to EBITDA) rather than absolute prices.

That is because prices per share are a function of the number of shares and are, in a sense, almost arbitrary. Before you respond with indignation, what I mean to say is that I can make the price per share decrease from $100/share to $10/share, by instituting a ten for one stock split, without changing anything about the company.

As a consequence, a stock cannot be classified as cheap or expensive based on price per share and you can find Berkshire Hathaway to be under valued at $263,500 per share, while viewing a stock trading at 5 cents per share as hopelessly overvalued.

在看股票是如何定价时,尤其是对不同股票的价格进行对比时,我们几乎会都会去看各种指标(PE, EV 和 EBITDA),而不会去看绝对价格。因为股票的每股价格由股票数量决定,在某种程度上,这是可以投机的。

先别急着生气,我这么说的意思是,只要把1只股拆分成10只股,股价就能从100美金掉到10美金每股,但是公司还是同一家。所以,我们无法根据每股价格的高低来判断股票是便宜还是昂贵,你会发现股价高达263,500美金的伯克希尔哈撒韦也被低估过,你也会绝望的发现交易价格才5美分的股票也还是会被高估。

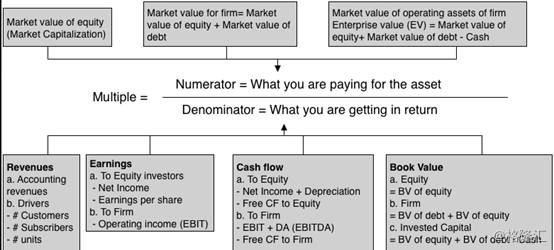

The process of standardizing prices is straight forward. In the numerator, you need a market measure of value of equity, the entire firm (debt + equity) or the operating assets of the firm (debt + equity -cash = enterprise value). In the denominator, you can scale the market value to revenues, earnings, accounting estimates of value (book value) or cash flows.

让价格标准化的过程很简单。把分子设为公司所有者权益、或整个公司(负债+所有者权益)的市场价值,也可以是公司的经营性资产价值(负债+所有者权益-现金=企业价值)。把分母设为营收,净收入,价值(账面价值)或者现金流的会计估值。

图片注释:

作者认为衡量股票价格是否“合理”的指标应该是:你为企业的资产支付的价格÷你所得的回报收益。分子可以为以下三项:(1),企业所有者权益的市场价值(市值);(2)企业的市场价值,也即企业所有者权益的市场价值+负债的市场价值;(3)企业经营性资产的市场价值,即所有者权益市场价值+负债的市场价值-现金。 分母可以是以下四项:营收,净收入,现金流,账面价值。

As you can see, there is a very large number of standardized versions of value that you can calculate for firms, especially if you bring in variants on each individual variable in the denominator.

With net income, for instance, you can look at income in the last fiscal year (current), the last twelve months (trailing) or the next year (forward). The one simple proposition that you should always follow is to be consistent in your definition of multiple.

如你所见,企业的价值有很多个标准化的计算版本,尤其是在分母的各个变量中再引入可变因素时更是如此。比如净利润这一项,你可以用上一财年的净利润(本期收益),也可以是过去12个月的收益(持续收益),或者是下一年的收益(预期收益)。需要遵守的一个简单的原则就是你给这个指标下的定义得始终保持一直。

The "Consistent Multiple" Rule: If your numerator is the market value of equity (market capitalization or price per share), your denominator has to be an equity measure as well (net income or earnings per share, book value of equity.

For example, a price earnings ratio is consistent, since both the numerator and denominator are equity values, and so is an EV to EBITDA multiple. A Price to EBITDA or a Price to Sales ratio is inconsistent, since the numerator is an equity value and the denominator is to the entire business, and will lead to conclusions that are not merited by the fundamentals.

“指标一致性”原则:如果分子是所有者权益的市场价值(即市值或者每股股价),分母就必须也按照所有者权益的方法计算(净利润,或者EPS或者是股权的账面价值)。例如,P/E这个指标符合“一致性”原则,因为分子、分母都是股权价值,EV(企业价值),EBITDA( 未计利息、税项、折旧及摊销前的利润)都是这类指标。股价/EBITDA,或者股价/营收都是不符合“一致性”原则的指标,因为分子指的是股权价值,分母是整个企业的,这回导致结果和基本面不符合。

Pricing – A Global Picture

价格-全球展图

To see how stocks are priced around the world at the start of 2017, I focus on four multiples, the price earnings ratio, the price to book (equity) ratio, the EV/Sales multiple and EV/EBITDA. With each multiple, I will start with a histogram describing how stocks are priced globally (with sub-sector specifics) and then provide country specific numbers in heat maps.

转载请注明出处。

相关文章

相关文章 精彩导读

精彩导读

热门资讯

热门资讯 关注我们

关注我们